Access to Finance

- Home

- Access to Finance

85% of MSMEs lack access to formal credit

Entrepreneurs require capital to start up and to grow. Limited access to capital at reasonable cost is a major deterrent to entrepreneurship and the growth of MSMEs.

Did you know

- 85% of MSMEs lack access to formal credit

- Assessed debt demand of MSMEs is INR 69.311 lakh crores, of which only 16% is formally financed.

- The cost of informal borrowing (~38% per annum) is at least twice that of formal borrowing.

Micro and Small enterprises are invariably exploited by larger buyers – both governments and large firms – when it comes to prompt payments. Delays of 6 months have become the norm. This amounts to about $200 billion – and this has become worse during the pandemic, adding to the woes of small firms as delays are inversely proportional to firm size. (for more about delayed payments, read our report)

Various government schemes (such as Emergency Credit Line Guarantee Scheme ECLGS) to support MSMEs hit by Covid, has led to deeper penetration of credit to firms that already had access to formal credit rather than the new to credit segment; and only about 10% of firms were able to avail them. (report)

Breaking through these twin challenges (delayed payments, access to credit for first time borrowers) is the focus of our GAME plan for supporting entrepreneurs.

GAME plan for Access to Finance

- Creation of new schemes and programs within the government ministry for enhancing access to capital for MSMEs. Undertake activities that lead to a creation of new schemes to benefit women led MSMEs, youth led MSMEs and those in emerging green sectors.

- Strengthening of last mile institutions facilitating credit to MSMEs with a focus on NBFCs to enhance access to low-cost capital through Alternate Investment Fund and through acceleration.

- Amplification and/or Acceleration and/or Adoption of Government Financing Schemes and Programs.

- Conduct activities that lead to a larger and effective uptake of Government schemes by MSMEs.

Our Vision

Identifying financing gaps in the ecosystem and addressing them through the creation of schemes favouring MSMEs.

Our Goal

Improving access to low-cost formal finance through creation and adoption of financing schemes/programs, strengthening the ‘middle mile’ of NBFCs /FinTechs, and providing thought leadership around policy.

Areas of focus

Innovations in credit

Supply chain financing & factoring

Break in business insurance

Finance for women entrepreneurs

Our Partners

Our Initiatives so far

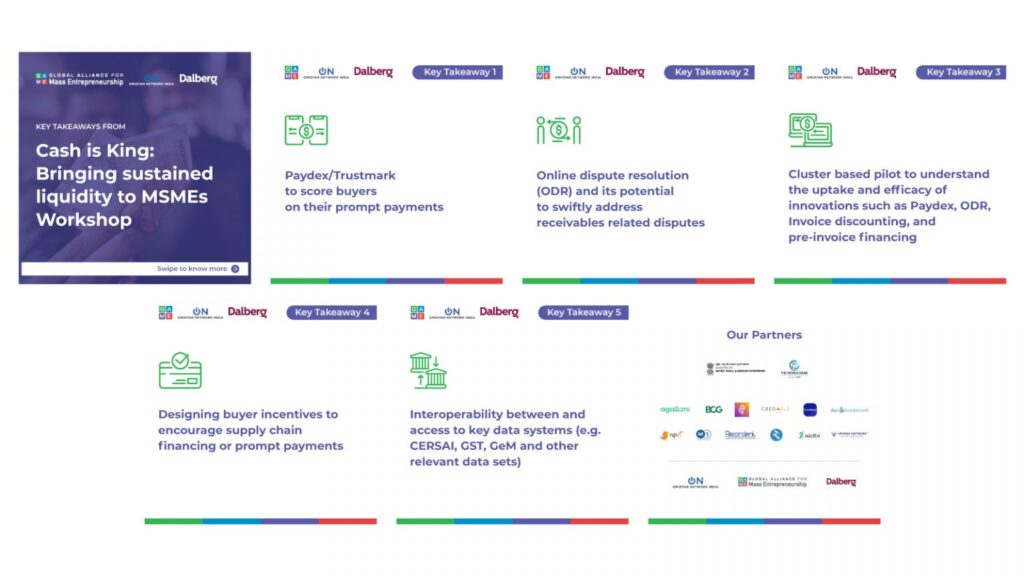

Working session to spur collaboration on delayed receivables

Delayed receivables are an existential risk to MSMEs and have system-wide implications. Estimates suggest that at least INR 15 lakh crore is stuck in delayed receivables, with average delays ranging from 3 to 6 months beyond the stipulated 45 days under the MSMED Act. A group of interested partners came together for a working session to build a common understanding of different initiatives and the support required for scale, Identify opportunities for collaboration, brainstorm and prioritise product pilots.

In the News

Got any questions or want to collaborate with us?

Contact UsQuick Links

© Copyright 2024 by JUNIOR ACHIEVEMENT INDIA SERVICES